The Gulf Cooperation Council (GCC) has emerged as a powerful force in the global conversation about climate action and sustainable development. At the crossroads of policy change, technological innovation, and green finance, the region stands at the threshold of a major economic transformation, fueled increasingly by foreign direct investment (FDI) into its burgeoning green economy. With the outcomes of COP28, ambitious projects like green hydrogen in Oman and Saudi Arabia, and initiatives from leaders like Masdar in the United Arab Emirates, the outlook for climate finance in the Middle East—especially in GCC markets—is more dynamic and promising than ever before.

The COP28 Catalyst: Recalibrating Regional Ambition

The COP28 conference proved to be a defining moment for the GCC states. For the first time, nearly 200 countries—including the Gulf nations—agreed to collectively shift away from fossil fuels by 2050, setting a global precedent for managing the energy transition in a “just, orderly, and equitable manner”. The conference’s outcomes reinforced the region’s commitment to net-zero goals (2050 for the UAE and Oman; 2060 for Saudi Arabia, Bahrain, Kuwait), driving a recalibration of energy policy toward renewables, decarbonized infrastructure, and sustainable urban development.

COP28 also facilitated meaningful dialogues between GCC countries and global climate actors. This laid the foundation for knowledge-sharing, regional collaboration, and a unified approach to technology investment and climate adaptation. Prominent among these collaborations is the Middle East Green Initiative, led by Saudi Arabia, targeting the planting of 40 billion trees and a 60% reduction of carbon emissions via clean hydrocarbon technologies.

A Green Investment Boom: Unlocking a $2 Trillion Opportunity

Green finance in the GCC is experiencing extraordinary growth, with the potential to unlock up to $2 trillion in cumulative GDP contribution and over 1 million jobs by 2030 through targeted investment across six key sectors, according to PwC Strategy& projections. This unprecedented opportunity is grounded in the region’s unique strengths—abundant, low-cost renewable energy resources (especially solar), and highly developed capital markets capable of absorbing and scaling sustainable finance.

Major policy tools are supporting this transformation. These include sustainability-linked bonds, green sukuk (Sharia-compliant bonds), and rigorous green finance frameworks modeled on successful global examples. Governments throughout the GCC—most notably the UAE, Oman, and Saudi Arabia—have enacted sustainable finance frameworks, transparency requirements, and reporting standards to channel FDI into impactful green projects, de-risk investments, and align returns with global ESG (Environmental, Social, and Governance) expectations.

Key recent developments include:

- Over $8.5 billion in green and sustainable bonds and sukuk were issued in the GCC in 2022, up from just $605 million in 2021—a remarkable 14-fold increase.

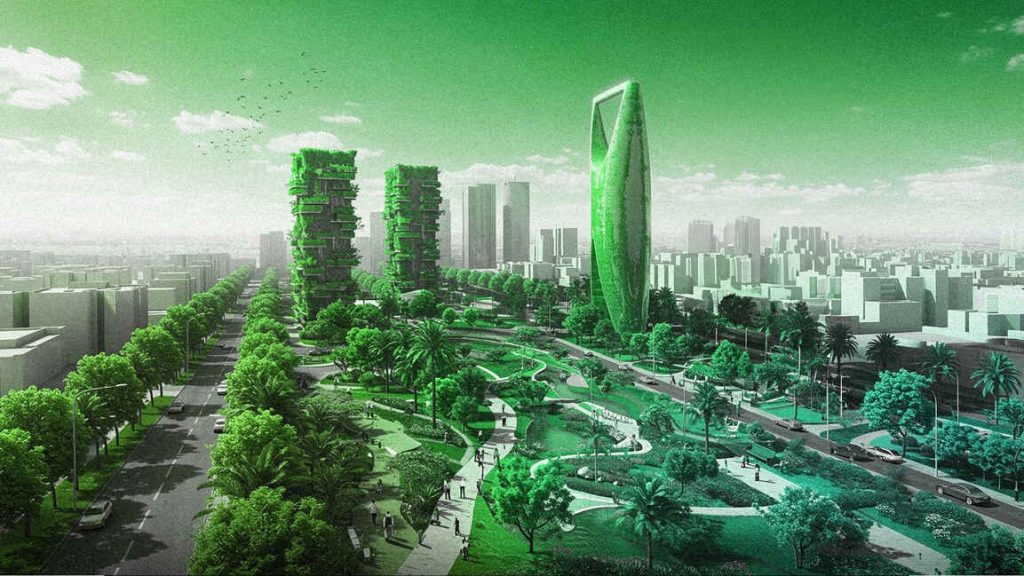

- GCC countries are investing in flagship sustainable cities (e.g., Masdar City, NEOM), green infrastructure, and renewable power generation to showcase regional ESG leadership.

- Private sector engagement is rising dramatically, with entities like Masdar, ACWA Power, and ADNOC at the forefront of green FDI flows into domestic and global projects.

Green Hydrogen in Oman and Saudi Arabia: Pioneering the Energy Transition

Two of the region’s most transformative investments are in green hydrogen—a technology heralded as the cornerstone of decarbonizing heavy industry and transport. Oman and Saudi Arabia have spearheaded this movement:

- Oman is scaling its ambitions to generate 30% of its power from renewables by 2030, partially through large-scale green hydrogen and ammonia projects backed by FDI and supported by the government’s 2024 Sustainable Finance Framework.

- Saudi Arabia, via ACWA Power and other local champions, is developing multi-billion-dollar hydrogen initiatives such as the NEOM Green Hydrogen Project and exporting know-how to partner economies (e.g., $4 billion green hydrogen plant in Egypt’s Suez Canal Economic Zone).

- These initiatives are attracting European, Asian, and regional investors, reinforcing the GCC’s role as a hub for green technology and cross-border energy partnerships.

Masdar: UAE’s Sustainable Investment Flagship

Founded in 2006, Masdar—Abu Dhabi’s renewable energy company—has become synonymous with GCC sustainability leadership and innovation. The company’s impact is visible across the region:

- Masdar City, a zero-carbon district in Abu Dhabi, demonstrates scalable solutions in urban sustainability.

- Multi-gigawatt wind and solar developments across the UAE, as well as international projects in emerging markets, are channeling billions in FDI.

- Masdar is leveraging partnerships to pilot green hydrogen projects and sustainable finance vehicles, positioning the UAE as an ESG investment center and a frontrunner for hosting future climate negotiations.

Regional ESG Frameworks: Setting the Standards

The acceleration of green investment in the GCC has been propelled by the adoption of ESG frameworks that underpin investor confidence and transparency:

- The UAE Sustainable Finance Framework (2021–2031) sets ambitious goals for sustainable lending and green bond issuance, with strict reporting standards to ensure impact.

- Oman’s Sustainable Finance Framework (2024) and Saudi Arabia’s Green Financing Framework (2024) are similarly driving decarbonization across financial systems and supporting the full ecosystem of banks, sovereign funds, and corporate issuers.

Nevertheless, challenges persist:

- The lack of a region-wide green taxonomy and harmonized enforcement hinders unified progress.

- ESG disclosure and data gaps need addressing to enhance market liquidity and cross-border green investment.

Returns Outlook: GCC Green Investments on the Global Stage

With climate finance proliferating and ESG benchmarks evolving, the returns outlook for green projects in the Gulf markets is increasingly favorable:

- Robust Growth: All GCC states expect non-oil GDP to expand (estimated 3–5% in 2025), thanks to renewable investments and sectoral diversification.

- Global Demand: There is rising international appetite for GCC-issued green bonds, sustainability-linked loans, and direct stakes in low-carbon infrastructure—partly due to the credibility of regional frameworks and the scale of planned projects.

- Institutional Momentum: Sovereign wealth funds in the GCC (e.g., ADIA, PIF) are deepening their sustainable investment portfolios, both domestically and abroad.

Conclusion: The Decisive Decade for Trillions in Sustainable Investment

The GCC stands at a defining juncture. The region’s rapid scaling of green investment, underpinned by policy reform, global climate leadership, and technological innovation, is reshaping its economic future—and positioning it as a bellwether for emerging-market climate finance worldwide. With COP28’s legacy, the surge in sustainable FDI, and the maturation of regional ESG standards, the GCC could unlock up to $2 trillion in green GDP growth and one million new jobs by 2030. To fully realize this potential, governments and markets must continue to prioritize transparent frameworks, cross-border collaboration, and the deployment of transformative technologies like green hydrogen and sustainable urban infrastructure