The GCC is undergoing a profound economic transformation, driven by bold vision plans, investor-friendly reforms, and a strategic shift from oil dependency to diversified growth. Saudi Arabia’s Vision 2030 leads the charge—showcasing how policy, infrastructure, and institutional design can synergize to magnetize capital and reshape economic trajectories.

1. A Region Reimagined: FDI’s Rising Role

In 2023, GCC countries witnessed a wave of confidence among global investors, with 1,889 new FDI projects valued at US $47 billion, according to EY. The UAE led in project count, while Saudi Arabia commanded the lion’s share of capital—over 60% of total FDI value.EY

This surge is anchored by sweeping national development plans—Saudi Vision 2030, Qatar National Vision 2030, and We the UAE 2031—all designed to usher economies from oil-dependence to diversified, innovation-led growth.EYWikipedia These plans have started to bear fruit: multiple sectors such as business services, software, IT, and infrastructure are drawing major investments.EY

2. Saudi Arabia: Vision 2030 as a Magnet for Global Capital

Ambition Meets Action

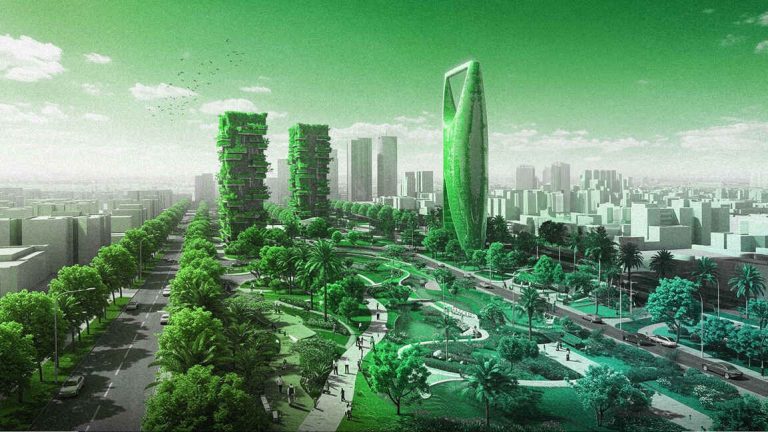

Launched in 2016, Saudi Vision 2030 aims to recast the Kingdom as a global investment powerhouse, a vibrant hub, and a cultural beacon connecting three continents.Wikipedia

Its ambitions rest on three pillars:

- Vibrant society: improving quality of life through urban, cultural, and entertainment initiatives.

- Thriving economy: strengthening non-oil sectors, empowering private enterprise, and attracting FDI.

- Ambitious nation: enhancing government efficiency, boosting non-oil revenues, and encouraging volunteering and digital transformation.Wikipedia

Mega Projects & Industrial Momentum

The strategy encompasses colossal “giga-projects” including NEOM, the Red Sea Project, Qiddiya, and others like New Murabba, Jeddah Central, and Soudah Peaks—collectively promising tens to hundreds of billions in economic activity.Wikipedia+1

As of the end of 2024, however, the Public Investment Fund (PIF) recorded an $8 billion write-down on mega-project valuations—highlighting the tension between scale and feasibility. Major projects like NEOM are being recalibrated toward essential infrastructure, especially ahead of hosting global events such as the 2034 World Cup.Reuters

Boosting FDI: Policies Driving Capital Inflows

Efforts to attract foreign investors have included:

- A regional headquarters program, granting 180 companies strategic entry points into Saudi markets, backed by tax incentives like 30-year corporate tax exemptions and zero income tax for foreign entities.FDI insider

- Aggressive privatisation, including the partial IPO of Aramco, channeling capital into the non-oil economy.FDI insider

- Foundation of Special Economic Zones (SEZs) offering regulatory relief, infrastructure, and tax advantages for targeted sectors.RasmalFDI insider

- The Made in Saudi initiative, launched in March 2021, which encourages domestic manufacturing and services, aiming to elevate the non-oil GDP contribution from around 16% to 50% by 2030.Wikipedia

- More transparent and rigorous FDI measurement: In 2022, net inflows rose 21% year-on-year to SAR 105.2 billion. Transport and storage accounted for SAR 52.2 billion, and manufacturing represented 31% of total FDI—underlining a significant diversification trend.Rasmal

These targeted actions have positioned Saudi Arabia as a top global destination for foreign investment—ranking 10th among G20 nations in terms of net FDI flows in 2022.Rasmal

Opening Up Regional Markets

A recent development further enhancing regional integration: UAE and GCC residents can now invest directly in Saudi Arabia’s stock exchange, Tadawul—a move seen as strengthening intra-GCC financial ties under Vision 2030.The Times of India

Growing Pains & Pragmatic Pivoting

While the ambitious giga‑projects continue, the $8 billion write-down reinforces the need for realistic timelines and focused investments. Analysts regard this recalibration as a positive strategic shift, preserving momentum while containing cost and risk.Reuters

3. Beyond Saudi: FDI Dynamics Across the GCC

Qatar: Building the Legal Foundation for Investment

Qatar is currently drafting three key laws—a bankruptcy law, a public-private partnership (PPP) law, and a new commercial registration law—as part of broader reforms to attract foreign capital. This legal revamp aims to support Qatar’s goal of $100 billion in FDI by 2030.Reuters

That said, Qatar experienced negative FDI inflow of $474 million in 2023, significantly lagging behind its neighbors.Reuters

Kuwait: Simplifying the Entry for Investors

Established in 2013, the Kuwait Direct Investment Promotion Authority (KDIPA) acts as a one-stop interface for foreign investors, streamlining regulatory processes and managing investment from inquiry to execution.Wikipedia

Bahrain: Positioning as Europe’s Gateway

With long-standing ties to the UK and cost-competitive advantages, Bahrain positions itself as the “gateway” for UK firms into the Gulf. It emphasizes sectors like green technology, advanced manufacturing, financial services, tourism, and infrastructure development amid its diversification drive.The Times

UAE: Trendsetter in FDI Volume & Diversification

The UAE leads the region in FDI project count—70% of GCC projects in 2023—but Saudi Arabia outpaces in capital volume.EY The country continues to reinforce its appeal through innovation ecosystems and strategic sectors like renewable energy, fintech, and tourism.

4. Key Lessons for Economic Development via FDI

- Vision-led strategies work: Well-articulated national plans (like Vision 2030) attract global capital and spur investor confidence.

- Structural reforms matter: Legal updates and investment-friendly laws (e.g., in Qatar) remove barriers and invite participation.

- Institutional support is essential: Agencies like KDIPA or Saudi’s Ministry of Investment are crucial intermediaries in simplifying investor journeys.

- Diversification through mega-projects works—when tempered with pragmatism: Projects like NEOM offer scale and ambition, but effective execution requires flexibility and risk management.

- Regional integration amplifies impact: Allowing GCC investors to tap into Saudi markets via Tadawul strengthens intra-regional capital flows.

Conclusion

The GCC is undergoing a profound economic transformation, driven by bold vision plans, investor-friendly reforms, and a strategic shift from oil dependency to diversified growth. Saudi Arabia’s Vision 2030 leads the charge—showcasing how policy, infrastructure, and institutional design can synergize to magnetize capital and reshape economic trajectories.

Regional players such as Qatar, Bahrain, Kuwait, and the UAE are also forging paths—whether through legal reform, cost competitiveness, investment facilitation, or diversification leadership.

As foundersclubint.com continues to profile GCC markets, highlighting these dynamics—and the interplay between ambitious vision and grounded implementation—will be invaluable. The future of investment in this region is defined not just by oil, but by strategy, transformation, and resilience.