Saudi Arabia’s Vision 2030 has ignited a real estate boom, with homeownership nearing its ambitious 70% target and residential investments surging past SAR 42 billion in 2024 alone. Mega-projects like ROSHN’s Sedra and New Murabba are transforming the urban landscape, while mortgage lending and property prices continue to climb—especially in Riyadh, where affordability is becoming a critical issue. This article explores how the Kingdom is balancing rapid development, rising demand, and policy reform to reshape its housing market—and what it means for investors, developers, and residents alike.

1. A Vision of Ownership—and a Rubicon of Demand

As part of its Vision 2030 goals, Saudi Arabia set out to elevate the national home‑ownership rate from about 47 percent in 2016 to 70 percent by 2030. Government initiatives have pushed ownership to approximately 63–65 percent by 2024, putting the Kingdom on a promising trajectory—though not without friction.Financial TimesRedditInvezz

2. Surge in Prices and Construction

- Property Appreciation: Residential prices in major cities have surged—apartments in Riyadh have climbed by over 60–62 percent in recent years, while villas in some areas have jumped by up to 75 percent since 2019; four-bedroom villas now average about SAR 2.8 million (~USD 747,000).Real Asset InsightInvezzFinancial Times

- Transaction Volumes Spike: Between 2023 and mid‑2024, the volume and value of residential deals swelled—volumes rose 48 percent, and total value reached SAR 42.4 billion (~USD 11.3 billion) in one year alone.Invezz

- Mortgage Boom: Mortgage lending soared—residential mortgages totalled SR 91.1 billion (~USD 24.6 billion) in 2024, with the total real estate loan book exceeding SR 850 billion (~USD 229.5 billion).Real Asset Insight

- Bank Lending Shifts: In Q1 2025, real estate loans hit a record SR 922 billion (~USD 246 billion). Notably, commercial real estate lending grew 27.5 percent, outpacing residential mortgage growth (~11.7 percent), signaling a boom in development financing.Arab News

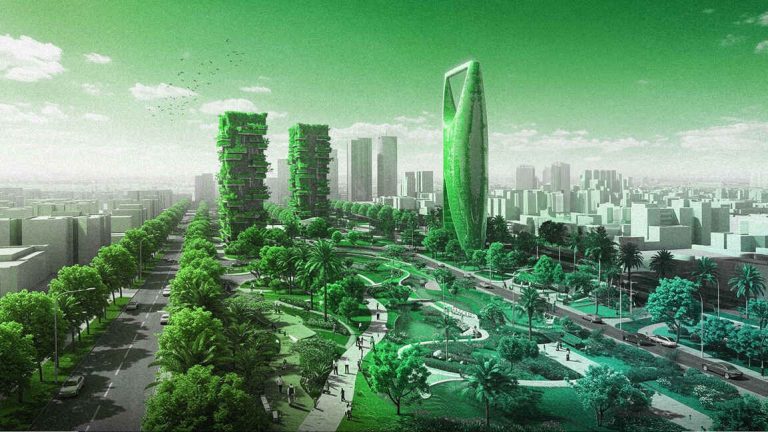

3. Mega‑Projects Fueling Supply—but at What Cost?

Major urban developments play a pivotal role in the housing boom:

- ROSHN’s Sedra Community: An integrated residential project in Riyadh’s north, Sedra constitutes Roshn’s flagship housing development—launched in phases since 2020, delivering thousands of modern, Najdi‑inspired homes.Wikipedia

- New Murabba & The Mukaab: A futuristic downtown area in Riyadh featuring the colossal “Mukaab”—a 400‑meter‑tall cube slated to include residential, commercial, leisure, and cultural spaces. Projects like New Murabba aim to contribute SAR 180 billion (~USD 48 billion) to non‑oil GDP and generate 334,000 jobs by 2030.Architectural DigestWikipedia

Such projects are reshaping the built environment—but mega‑scale ambition brings higher cost, execution complexity, and delivery risk.

4. Affordability Challenges and Social Disparities

Though ownership is rising, soaring prices outpace incomes—especially in Riyadh:

- A three‑bedroom villa averages around SAR 2.28 million (~USD 608,000), while average annual salary is about SAR 121,908 (~USD 32,500)—making homeownership increasingly out of reach for many.Financial Times

- Housing supply outside Riyadh remains more affordable; in Jeddah, house prices have even dipped by ~8 percent since 2020.Financial Times

- Roshn’s integrated communities target upper‑middle income buyers, with housing priced between SAR 800,000 and SAR 2.5 million—a level beyond what approximately two-thirds of Saudis can afford (most cap budgets at SAR 1.5 million).Financial TimesInvezz

- High demand has inspired calls for more built‑to‑rent housing targeted at the young workforce, who often prefer renting over committing to ownership.Invezz

5. Governmental Policy Response

Saudi authorities are striving to mitigate strains in the housing market through bold interventions:

- Subsidized Housing & Loans: The National Housing Company is constructing over 30,000 affordable units—from around SR 375,000 (~USD 100,000)—off‑plan, complemented by subsidized mortgage loans.Financial Times

- Stabilization Measures Amid Inflation: As of June 2025, housing rent inflation stood at 7.6 percent (villa prices up 7.1 percent), contributing to overall housing and utilities rising 6.5 percent. To counter this, the government is capping prices on residential plots and preparing a new Real Estate Ownership & Investment Law to allow greater property ownership by foreigners starting 2026.Reuters

- Foreign Ownership Liberalization: Enacted in July 2025, the law permits non‑Saudis to directly purchase real estate in designated areas, excluding Makkah and Madinah, boosting investment prospects.Real Asset Insight

6. Economic Implications & Market Outlook

- Construction Sector Momentum: The pace of development is accelerating.¹ Forecasts estimate Saudi’s construction output hitting ~$181 billion by 2028, with residential accounting for ~31 percent—boosted by Vision 2030‑driven demand and mega‑projects.Reddit

- S&P Forecast & Demand Dynamics: S&P projects persistent housing demand, bolstered by continued inflows of expatriates, new companies, and lower interest rates from late‑2024 onward. The shortage of housing supply in cities like Riyadh will continue to pressure prices.Agaam

- Morale and Market Sentiment: Despite rising costs, a growing number of Saudis look favorably upon owning homes—72 percent are aspiring homeowners—reflecting sustained demand.Arab News

- Foreign Investor Attraction: Long‑term residency schemes, including the Premium Residency Permit, are driving high‑value real estate investments. Requirement of minimum SAR 4 million investment is stimulating luxury market activity.Sands Of Wealth

7. Balancing Growth With Accessibility

Saudi Arabia’s housing boom is double‑edged: while accomplishing impressive development, it also triggers affordability concerns.

Strengths:

- Clear targets (70 percent homeownership) and supportive policies.

- Massive delivery of supply through mega‑projects and mortgages.

- Private sector activation alongside public funding.

Challenges:

- Affordability gaps, particularly for middle and lower‑middle‑income families.

- Delivery and timeline risks in megaprojects.

- The need for diversified housing models—like rental stock and mid‑market financing.

Strategy Recommendations for Foundersclubint.com Audience:

- Highlight how economic zones and housing affordability affect FDI and talent mobility.

- Explore partnerships in modular/rental housing, smart finance, or green building tech.

- Stress the role of sustainability—70 percent of large projects now follow sustainability guidelines, with rising consumer demand for eco‑friendly homes.Sands Of Wealth

Conclusion

Saudi Arabia’s housing boom under Vision 2030 is nothing short of monumental: soaring transaction volumes, expansive mortgage financing, and city‑shaping projects are rewriting the real estate narrative. Yet, this success comes wrapped in challenge—affordability, delivery risks, and demographic diversity must be navigated carefully.

For foundersclubint.com, the Kingdom’s real estate transformation offers compelling insights: it’s a theatre where policy, economics, investors, and everyday citizens intersect. Whether you’re profiling FDI in housing, smart‑city innovation, or sustainable finance, the Saudi story is urgent, high‑stakes, and evolving fast.